Cheapskates Bill Paying System

Paying your bills on time will help you avoid late fees and interest charges. It's easy to keep your finances in order and avoid these unnecessary fees and charges. With the Cheapskates Journal Bill Paying System you'll have no excuse for not paying your bills on time. You'll have everything you need in one neat, handy place, ready for you to quickly and easily dispose of those bills.

You'll also find planners to help you work your budget and dispose of that outstanding debt.

You will see at a glance what bills have been paid and what bills are outstanding. It is simple and takes less than two minutes each time you receive a bill!

To make your own bill paying system you will need:

How to use Cheapskates Journal Bill Paying System:

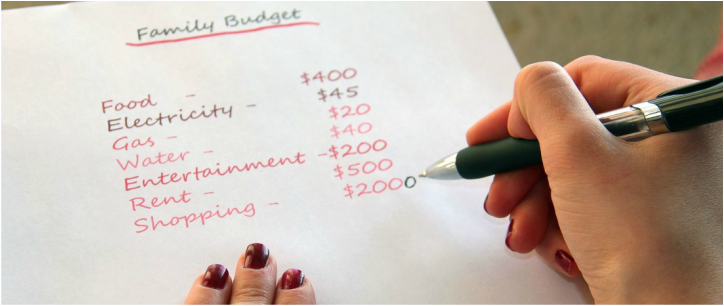

Set up the dividers for your bill categories i.e. Electricity, Gas, Phone, House Insurance etc. If you have more than 10 regular bills combine them into one category i.e. Utilities could include electricity, gas and water, Insurance could include house and contents etc.

Collect all your current bills and fill out the necessary record sheets, as listed below. Then store the bills in the plastic sleeve at the front of your Bill Paying System until you are ready to pay them.

Bill Payment Reminder Sheet

Use this to note regular bills throughout the year i.e. insurances, rates, school fees and other regular bills. This will show you at a glance which bills are due each month.

Pay Day Bill Payment Planning Sheet

This helps you sort your bills out by payday so you have approximately the same amount of money coming out on each payday. Each sheet covers one month. If you are paid weekly, fill out the details for each week. If you are paid fortnightly or monthly do the same thing so that you can see what you need to pay at a glance.

Monthly Bill Summary

Use this to list your bills in the order in which they need to be paid each month. This sheet will help you quickly identify which bills have been paid and which are still to be paid. You will need one of these per month.

Daily Spending Record

Keep a track of where your money is going by recording what you spend. After a few weeks you'll see where the leaks are and you can adjust your spending and your budget to fix these.

Payment Push Planning Sheet

If you want to eradicate debt, use the Payment Push Planning Sheet to list your debts and work out the fastest and easiest way to eliminate them. See separate notes on using the Payment Push Planning Sheet.

Financial History

Keep a summary of large bills and/or debts that you have successfully paid off. If you ever need to know when a debt was finalized, this sheet will be able to tell you at a glance. You can then go to the appropriate file to find the details.

Record of Donations/Charitable Contributions

It's nice to be able to give to charities when they ask, but it you don't keep a record of what you give and who you give it to tax time can be a nightmare. Having this information at your fingertips will mean you'll get the tax benefits. When its time to pay your bills:

Set a regular time to pay your bills. It could be on payday (recommended) or the same date each month i.e. 15th of the month, 1st of the month, 30th of the month etc.

On payday, look at your Pay Day Planner to see which bills need to be paid from the current pay day and the next. Write out your cheques for these bills and get them ready to mail, pay via Bpay or whatever your preferred method of payment may be.

Once the bills are paid, file all statements in the pocket divider corresponding to that bill.

On the last day of the month, complete the Bill Planner form, so you can keep track of your monthly expenses over a six-month period. This will give you a good track record of your bills so that you can establish an accurate budget. Start a new Monthly Bill Summary and Pay Day Planner for each new month.

You'll also find planners to help you work your budget and dispose of that outstanding debt.

You will see at a glance what bills have been paid and what bills are outstanding. It is simple and takes less than two minutes each time you receive a bill!

To make your own bill paying system you will need:

- A ring binder (I prefer 3 ring, it's up to you

- Bill Payment Reminder Sheet

- Pay Day Bill Payment Planning Sheet

- Bill Summary

- Daily Spending Record

- Monthly Payment Push Planning Sheet

- Financial History

- Record of Donations/Charitable Contributions

- 12 Coloured index dividers

- 12 page protectors

How to use Cheapskates Journal Bill Paying System:

Set up the dividers for your bill categories i.e. Electricity, Gas, Phone, House Insurance etc. If you have more than 10 regular bills combine them into one category i.e. Utilities could include electricity, gas and water, Insurance could include house and contents etc.

Collect all your current bills and fill out the necessary record sheets, as listed below. Then store the bills in the plastic sleeve at the front of your Bill Paying System until you are ready to pay them.

Bill Payment Reminder Sheet

Use this to note regular bills throughout the year i.e. insurances, rates, school fees and other regular bills. This will show you at a glance which bills are due each month.

Pay Day Bill Payment Planning Sheet

This helps you sort your bills out by payday so you have approximately the same amount of money coming out on each payday. Each sheet covers one month. If you are paid weekly, fill out the details for each week. If you are paid fortnightly or monthly do the same thing so that you can see what you need to pay at a glance.

Monthly Bill Summary

Use this to list your bills in the order in which they need to be paid each month. This sheet will help you quickly identify which bills have been paid and which are still to be paid. You will need one of these per month.

Daily Spending Record

Keep a track of where your money is going by recording what you spend. After a few weeks you'll see where the leaks are and you can adjust your spending and your budget to fix these.

Payment Push Planning Sheet

If you want to eradicate debt, use the Payment Push Planning Sheet to list your debts and work out the fastest and easiest way to eliminate them. See separate notes on using the Payment Push Planning Sheet.

Financial History

Keep a summary of large bills and/or debts that you have successfully paid off. If you ever need to know when a debt was finalized, this sheet will be able to tell you at a glance. You can then go to the appropriate file to find the details.

Record of Donations/Charitable Contributions

It's nice to be able to give to charities when they ask, but it you don't keep a record of what you give and who you give it to tax time can be a nightmare. Having this information at your fingertips will mean you'll get the tax benefits. When its time to pay your bills:

Set a regular time to pay your bills. It could be on payday (recommended) or the same date each month i.e. 15th of the month, 1st of the month, 30th of the month etc.

On payday, look at your Pay Day Planner to see which bills need to be paid from the current pay day and the next. Write out your cheques for these bills and get them ready to mail, pay via Bpay or whatever your preferred method of payment may be.

Once the bills are paid, file all statements in the pocket divider corresponding to that bill.

On the last day of the month, complete the Bill Planner form, so you can keep track of your monthly expenses over a six-month period. This will give you a good track record of your bills so that you can establish an accurate budget. Start a new Monthly Bill Summary and Pay Day Planner for each new month.