Sentry Page Protection

Guaranteed Peace of Mind

JANUARY 2008

You're holding your own and the budget is working out. That is until, out of the blue, Murphy comes calling and you need to replace the fridge. Or Junior's orthodontia bill doubles due to the genetic over-bite you didn't know he had. Not a problem, that's what you kept your one and only credit card for. Problem solved.

Wrong! If you don't have the money to buy your new fridge (or pay the orthodontist) then you don't have the money to pay off the credit card bill at the end of the month and you are back on the debt cycle again. Unexpected expenses like these aren't really unexpected. You have always known that at some stage you would need to replace the fridge. Chances are you've know for a few years about Juniors upcoming braces ordeal. The problem was that you didn't allow for these irregular expenses in your budget.

The peace of mind you thought you had has gone. In it's place is the stress you used to feel when you were trying to pay the bills at the end of the month.

What you need is a peace of mind account. Your peace of mind account is where you deposit regular amounts to cover irregular expenses: furniture replacement, emergency medical expenses, unexpected car repairs etc. Depositing regularly lets the balance build up so the when Murphy calls you can cover the expense without having to thaw out your credit card.

A peace of mind account isn't complicated or hard to use. It does however give you a sense of security and that peace of mind I keep talking about.

I suggest that you open a separate account, either online or at your bank or credit union. Look for an account with low or no fees that allows you to transfer money between your existing accounts. As you are going to be building the balance up look for an account without fees, that pays at least some interest.

Once you have your peace of mind account set up sit for a few minutes and think of all the irregular expenses you have had or could possibly have: car repairs, plumbing problems, unexpected medical expenses etc. If you have the information, jot down roughly how much each one was. While you're thinking and jotting make a list of all the other expenses you've had in the last year that weren't covered in your budget: family weddings, unexpected trips, school camps, birthdays, Christmas (yes, there are some who don't budget for this regular expense), crafts and hobbies etc.

Take your list and work out how much you need to add to the Peace of Mind account each week to be able to cover these expenses when they crop up. For example, your new fridge cost $1,200. You have a two year warranty on it, so hopefully you won't need to replace it for at least two years. To be able to replace the fridge when it expires you need to add $11.50 a week to the account ($1200 / 2 = 2 x $600 / 52 = $11.54). School camps last year cost $478 so you'll need to add $9.20 to the account each week to cover the cost.

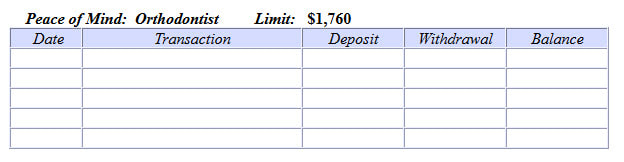

It is essential that you track what's going in and out of this account and keep a record, so you'll know if you have the money to cover an irregular expense when it crops up. I use an exercise book with one item to a page. Each item is an irregular expense and it's page is ruled into columns: date, transaction, deposit, withdrawal and balance.

It looks like this:

Wrong! If you don't have the money to buy your new fridge (or pay the orthodontist) then you don't have the money to pay off the credit card bill at the end of the month and you are back on the debt cycle again. Unexpected expenses like these aren't really unexpected. You have always known that at some stage you would need to replace the fridge. Chances are you've know for a few years about Juniors upcoming braces ordeal. The problem was that you didn't allow for these irregular expenses in your budget.

The peace of mind you thought you had has gone. In it's place is the stress you used to feel when you were trying to pay the bills at the end of the month.

What you need is a peace of mind account. Your peace of mind account is where you deposit regular amounts to cover irregular expenses: furniture replacement, emergency medical expenses, unexpected car repairs etc. Depositing regularly lets the balance build up so the when Murphy calls you can cover the expense without having to thaw out your credit card.

A peace of mind account isn't complicated or hard to use. It does however give you a sense of security and that peace of mind I keep talking about.

I suggest that you open a separate account, either online or at your bank or credit union. Look for an account with low or no fees that allows you to transfer money between your existing accounts. As you are going to be building the balance up look for an account without fees, that pays at least some interest.

Once you have your peace of mind account set up sit for a few minutes and think of all the irregular expenses you have had or could possibly have: car repairs, plumbing problems, unexpected medical expenses etc. If you have the information, jot down roughly how much each one was. While you're thinking and jotting make a list of all the other expenses you've had in the last year that weren't covered in your budget: family weddings, unexpected trips, school camps, birthdays, Christmas (yes, there are some who don't budget for this regular expense), crafts and hobbies etc.

Take your list and work out how much you need to add to the Peace of Mind account each week to be able to cover these expenses when they crop up. For example, your new fridge cost $1,200. You have a two year warranty on it, so hopefully you won't need to replace it for at least two years. To be able to replace the fridge when it expires you need to add $11.50 a week to the account ($1200 / 2 = 2 x $600 / 52 = $11.54). School camps last year cost $478 so you'll need to add $9.20 to the account each week to cover the cost.

It is essential that you track what's going in and out of this account and keep a record, so you'll know if you have the money to cover an irregular expense when it crops up. I use an exercise book with one item to a page. Each item is an irregular expense and it's page is ruled into columns: date, transaction, deposit, withdrawal and balance.

It looks like this:

Once you've set up your Peace of Mind account you need to treat it just as you would any other bill. You must make regular deposits into it for it to work. You'll also need to decide on limits for some of the items i.e. that new fridge. When you reach the yearly limit for each item you can stop making deposits until next year. And, once you've banked the total money needed, you can stop adding to that account. The money is then there, ready and waiting for you to buy a new fridge or pay for the school camp. I suggest that you apply that money to your emergency fund to give it a boost.

Lastly, remember that this isn't a savings account or an emergency fund. This is a spending account. The money in this account is to be used to cover those irregular bills and give you peace of mind.

Lastly, remember that this isn't a savings account or an emergency fund. This is a spending account. The money in this account is to be used to cover those irregular bills and give you peace of mind.