Sentry Page Protection

How Much Money is Enough?

In the course of Cheapskates workshops, writing newsletters, library talks and running the Cheapskates Club I get asked, just about daily, how much money is enough.

Enough for a grocery budget. Enough to live on. Enough to retire on. Enough to be happy.

Well, if you ask a billionaire, he’ll likely respond that no amount is enough. Others might reflectively say, “One million dollars.” Those that are more thoughtful might have a different number.

There comes a point when there might be a better way to spend your time than chasing more money. But here's the rub: you’ll never know if you’ve reached that point if you don’t define it.

Studies have shown that happiness doesn't increase beyond an income of $70-75k per year. That’s a comfortable living in most parts of the country, but it’s not enough to drive a new Mercedes every three years and holiday in Europe with the family every year. It would be tough to send your child to university on a $70,000 salary (although we did put three children through private school and two through university on a lot less - and paid fees in cash at the beginning of each year).

So how much is enough? It depends on you, your circumstances and your expectations.

Consider how much you need to live fully:

1. How old are you? How much longer do you expect to live? If you’re 90, you probably require less money for the rest of your life than someone that just turned 30. There are actuarial tables that can tell you how much longer you’re expected to live. Plan to live longer than expected!

2. How much are your monthly expenses? What would your expenses be if you were living the life of your dreams? Let your imagination run wild. What expenses would you have? A new bowling ball each year or a second house on the Sunshine Coastl? A housekeeper? A thoroughbred? It’s your life. Determine how much it would take to finance your ideal life.

3. Who are you responsible for? Do you have three children that will attend university in the next 10 years? Do you have a spouse that doesn’t work? Do you care for an aging parent? For how long do you expect to financially provide for others?

4. What is your current debt situation? Do you have 20 years left on a mortgage hanging over your head? Significant medical bills? Credit cards?

5. When would you like to retire and how much do you need each month to live comfortably? How would you like to spend your retirement? Do you want to travel regularly? Play golf every day? How much would a typical month in retirement cost?

Maybe you value your free time above all else and would be happy living a simple life with a Labrador retriever and a large vegetable garden, reading books all afternoon.

Or perhaps you want to be able to take a cruise each winter, eat out three times a week and see every show that comes to town.

Just like you've practiced living on a single income in preparation for raising a family, practice living on your retirement income now. We are currently living on what is considered a modest single retirement income. We've been doing it for years so when we do finally retire there won't be a huge income shock for us.

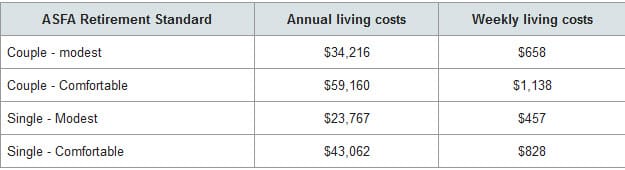

The following was taken from the ASICS moneysmart website.

"The table below will give you a rough idea of how much money you need to support a modest or comfortable retirement. It applies for people retiring at age 65 who will live to an average life expectancy of about 85."

Enough for a grocery budget. Enough to live on. Enough to retire on. Enough to be happy.

Well, if you ask a billionaire, he’ll likely respond that no amount is enough. Others might reflectively say, “One million dollars.” Those that are more thoughtful might have a different number.

There comes a point when there might be a better way to spend your time than chasing more money. But here's the rub: you’ll never know if you’ve reached that point if you don’t define it.

Studies have shown that happiness doesn't increase beyond an income of $70-75k per year. That’s a comfortable living in most parts of the country, but it’s not enough to drive a new Mercedes every three years and holiday in Europe with the family every year. It would be tough to send your child to university on a $70,000 salary (although we did put three children through private school and two through university on a lot less - and paid fees in cash at the beginning of each year).

So how much is enough? It depends on you, your circumstances and your expectations.

Consider how much you need to live fully:

1. How old are you? How much longer do you expect to live? If you’re 90, you probably require less money for the rest of your life than someone that just turned 30. There are actuarial tables that can tell you how much longer you’re expected to live. Plan to live longer than expected!

2. How much are your monthly expenses? What would your expenses be if you were living the life of your dreams? Let your imagination run wild. What expenses would you have? A new bowling ball each year or a second house on the Sunshine Coastl? A housekeeper? A thoroughbred? It’s your life. Determine how much it would take to finance your ideal life.

3. Who are you responsible for? Do you have three children that will attend university in the next 10 years? Do you have a spouse that doesn’t work? Do you care for an aging parent? For how long do you expect to financially provide for others?

4. What is your current debt situation? Do you have 20 years left on a mortgage hanging over your head? Significant medical bills? Credit cards?

5. When would you like to retire and how much do you need each month to live comfortably? How would you like to spend your retirement? Do you want to travel regularly? Play golf every day? How much would a typical month in retirement cost?

Maybe you value your free time above all else and would be happy living a simple life with a Labrador retriever and a large vegetable garden, reading books all afternoon.

Or perhaps you want to be able to take a cruise each winter, eat out three times a week and see every show that comes to town.

Just like you've practiced living on a single income in preparation for raising a family, practice living on your retirement income now. We are currently living on what is considered a modest single retirement income. We've been doing it for years so when we do finally retire there won't be a huge income shock for us.

The following was taken from the ASICS moneysmart website.

"The table below will give you a rough idea of how much money you need to support a modest or comfortable retirement. It applies for people retiring at age 65 who will live to an average life expectancy of about 85."

6. What toys do you want to own? A plane? A Porsche? A boat? A second home? Swimming pool? Motorcycle?

Money is great for a couple of things: primarily, solving problems and providing choices. It has limited value beyond those two purposes. It’s a mistake to use money for establishing status. To be worried about impressing your peers is best left to your teenager, they seem to be able to do it best. Needing money for the wrong things is limiting. It requires working longer and harder than necessary.

You could be doing other things with your limited time on Earth.

There’s no set answer to the question, “How much money is enough?” It’s completely dependent on your desires and circumstances. The number might be quite small or very high.

It’s your number.

If you’ve never considered how much money you need, take the time to think about it.

Think long and hard about what is most important to you. Ensure that you develop an income, savings and net worth to acquire the possessions and freedom that will allow you to live your life in the way you desire. Spend time addressing this important issue. You might be able to quit working sooner than you think.

6. What toys do you want to own? A plane? A Porsche? A boat? A second home? Swimming pool? Motorcycle?

Money is great for a couple of things: primarily, solving problems and providing choices. It has limited value beyond those two purposes. It’s a mistake to use money for establishing status. To be worried about impressing your peers is best left to your teenager, they seem to be able to do it best. Needing money for the wrong things is limiting. It requires working longer and harder than necessary.

You could be doing other things with your limited time on Earth.

There’s no set answer to the question, “How much money is enough?” It’s completely dependent on your desires and circumstances. The number might be quite small or very high.

It’s your number.

If you’ve never considered how much money you need, take the time to think about it.

Think long and hard about what is most important to you. Ensure that you develop an income, savings and net worth to acquire the possessions and freedom that will allow you to live your life in the way you desire. Spend time addressing this important issue. You might be able to quit working sooner than you think.

Related Articles |