Sentry Page Protection

How We Are Going to Live on a (Really) Tight Budget

9th November 2015

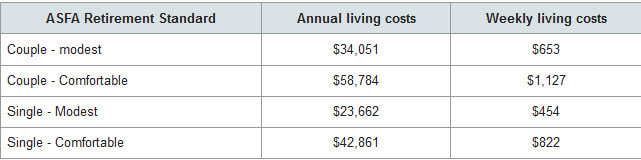

A few weeks ago Joy posted some statistics in the forum pertaining to how much money is needed to live in retirement.

The following was taken from the ASICS moneysmart website.

"The table below will give you a rough idea of how much money you need to support a modest or comfortable retirement. It applies for people retiring at age 65 who will live to an average life expectancy of about 85."

The following was taken from the ASICS moneysmart website.

"The table below will give you a rough idea of how much money you need to support a modest or comfortable retirement. It applies for people retiring at age 65 who will live to an average life expectancy of about 85."

Those figures stunned me, and not in a bad way!

We live on a tight budget. We don't carry any debt. If we want something we pay cash for it. If we don't have the cash we save up until we do, then we buy it.

Our lifestyle isn't extravagant but it's not stingy either. We don't go without anything we need. We mostly don't go without anything we want either. We do think about our purchases and our spending, and rarely have any spontaneous spending. That is mostly because there's not much we need or want that we don't already have.

We live on a tight budget. We don't carry any debt. If we want something we pay cash for it. If we don't have the cash we save up until we do, then we buy it.

Our lifestyle isn't extravagant but it's not stingy either. We don't go without anything we need. We mostly don't go without anything we want either. We do think about our purchases and our spending, and rarely have any spontaneous spending. That is mostly because there's not much we need or want that we don't already have.

We eat well. I cook from scratch (real scratch, not packet scratch). I grow a lot of the vegetables and some of the fruit we eat. I have a strict budget for meat and poultry and shop once a quarter for those foods, timing the shop around the best sale prices.

I am a bit of a power warden, reminding the family to turn lights, appliances and power points off (if they're not powering something essential like the fridge or freezer).

We catch water in buckets in the showers and I have a tub I use to catch water from the kitchen sink. This water is either tipped into the washing machine, used to water the pot plants, wash veggies or for cleaning. It doesn't go to waste.

So why was I happily stunned with those figures?

Well because as a family we're living well under them. We have started living on our 2016 budget (yes, it's kicked in a couple of months early) and according to those figures we are living on the Single Modest retirement income of $454 a week!

We catch water in buckets in the showers and I have a tub I use to catch water from the kitchen sink. This water is either tipped into the washing machine, used to water the pot plants, wash veggies or for cleaning. It doesn't go to waste.

So why was I happily stunned with those figures?

Well because as a family we're living well under them. We have started living on our 2016 budget (yes, it's kicked in a couple of months early) and according to those figures we are living on the Single Modest retirement income of $454 a week!

Our weekly budget is $454.81! And that covers everything we need to survive and a few non-essentials too. Now bear in mind there are five adults living in our house. I am feeding five adults, there are five computers, three TVs, five people showering every day. And yet we can manage on less than a single modest retirement income and we are not going without and we don't feel deprived at all.

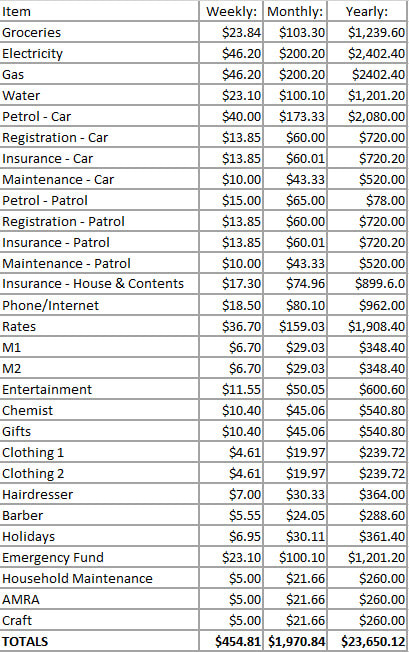

Here is our current Spending Plan:

Here is our current Spending Plan:

As we are and will be living off our stockpile, the grocery budget has shrunk considerably.

There is wiggle room in this budget. I've factored in haircuts for both of us, pin money and a craft allowance. These are all flexible and non-essential. I can cut Wayne's hair and if push comes to shove I can either stretch my monthly trip to the hairdressers to every second month or just let my hair grow (or act as a model for Hannah so she can practise cutting!).

There is wiggle room in this budget. I've factored in haircuts for both of us, pin money and a craft allowance. These are all flexible and non-essential. I can cut Wayne's hair and if push comes to shove I can either stretch my monthly trip to the hairdressers to every second month or just let my hair grow (or act as a model for Hannah so she can practise cutting!).

I've included an entertainment allowance. We rarely (maybe once a year) eat out so it's covered if we do, but the main purpose of this category is to give us time out when we need it. We tend to go camping (usually free camping) or on day trips and this amount will pay for petrol and camp fees so we can have at least a few days away during the year. Entertainment also covers expenses birthday celebrations, anniversaries and any other fun things we do during the year.

There is a separate Holiday category. We are saving up for another big trip so steady, regular saving will help us get there in 2017. It's flexible, again if for some reason I've miscalculated our expenses I can shift this money to another category.

There is a separate Holiday category. We are saving up for another big trip so steady, regular saving will help us get there in 2017. It's flexible, again if for some reason I've miscalculated our expenses I can shift this money to another category.

The one thing that isn't flexible, that is set in cement, is our Emergency Fund category. An emergency fund is essential and even on a tight budget we will continue to build ours. I've been asked if we'll be dipping into our emergency fund next year to cover any shortfall in our income. The short answer is no.

Our budget has been re-worked, we've gone over the figures and double checked them and unless there is a major emergency i.e. the washing machine blows up and there's not enough in Household Maintenance to cover replacing it, then we won't be touching it.

We will thrive on our current budget because we don't live extravagantly. We live a modest lifestyle and we are happy. The bills will be paid, we have food to eat, clothes to wear, a roof over our heads. The present box is bulging with gifts for 2015, 2016, 2017 and I've started on 2018 (we have a couple of weddings in 2018 and the presents are ready and waiting). There are veggies growing in the garden.

So yes, those figures for a retirement budget have made me very happy. I know we'll manage next year and I'm reassured that when we're ready to retire we'll be able to manage on a "retirement" income too.

Our budget has been re-worked, we've gone over the figures and double checked them and unless there is a major emergency i.e. the washing machine blows up and there's not enough in Household Maintenance to cover replacing it, then we won't be touching it.

We will thrive on our current budget because we don't live extravagantly. We live a modest lifestyle and we are happy. The bills will be paid, we have food to eat, clothes to wear, a roof over our heads. The present box is bulging with gifts for 2015, 2016, 2017 and I've started on 2018 (we have a couple of weddings in 2018 and the presents are ready and waiting). There are veggies growing in the garden.

So yes, those figures for a retirement budget have made me very happy. I know we'll manage next year and I'm reassured that when we're ready to retire we'll be able to manage on a "retirement" income too.