Sentry Page Protection

Meet the Bumsteads - 2010 Budget Renovation

....Blondie, Dagwood and their children Alexander and Cookie as they participate in their year long Budget Renovation and begin living life debt free, cashed up and laughing - the Cheapskates way.

Meet the Bumsteads - Part 1

Late last year Dagwood wrote

"Help us please. We are working harder than ever and earning more than we ever have but no matter how hard we try we just don't get ahead. It's really getting both of us down. I spend hours sitting at the computer trying to figure out where the money is going and getting depressed. The bills are just mounting up and we are getting further and further behind. Please show us how we can get out of debt and start saving for a home of our own. I don't want to be renting when I retire!"

So lets meet the Bumsteads:

Blondie - a 48 year old wife and mother, working full time in an office a few suburbs away from home. Each weekday she leaves home at 8am, and drops the kids to school before heading off to start work at 9am. The kids get the bus home. She is supposed to finish work at 5pm, but at least 4 nights a week works over, and gets home between 6.30 - 7.30. Too tired to cook tea she picks up takeaway on way home or rings ahead for delivery, trying to choose the healthier options of charcoal chicken and salad or Chinese rather than pizza, fish and chips or burgers. She shops at her local supermarket in a big shopping centre on Saturday because she is simply too tired and busy with housework to be bothered going a little further to Aldi. Blondie has no organized menu plan or shopping list, rather just buys as she sees and thinks about groceries. There is no clothing plan for the family so she buys spontaneously or in an emergency shopping run when a garment is needed. There is no gift box or gift plan so again the shopping mall dash does the job, and poor Blondie ends up spending more than intended simply because there is no plan.

Dagwood - a 48 year old cabinet maker, employed by a local contractor, works 6 days a week, leaves home 7am , arrives back 6.30pm most days. Dagwood goes fishing to relax and this can cost $100 or more each time he goes, depending on how far he travels and whether or not he takes his little tinny. Towing the boat adds significantly to the cost of his hobby. He and Alexander often leave early on a Sunday morning to take the boat out and hopefully catch some fish. Otherwise he spends his time at home mowing the lawn or relaxing with the paper.

Alexander - in year 12, and the pressure is on. School supplies have been very expensive - Blondie forgot the second-hand book sale at the end of last year and so missed out on some cheaper textbooks. Alexander is on his Ls and gets his practice driving to school and each weekend when Dagwood takes him out for a drive. He spends most of his time studying or playing games on computer (online of course). Alexander often has friends over for gaming nights and Blondie has to feed them all, plus cover the extra electricity and broadband allowance that another 5 laptops use etc

Cookie - the social butterfly of the family. In year 8, Cookie is the most expensive member of the Bumstead family. She always needs cash for something - dancing, piano, school assignments/excursions/clothes/shoes/presents for friends/parties etc. Cookie Is generous to a fault and sending her parents broke with her generosity. She too often has friends over for weekend and holiday sleepovers - Blondie feeds them all - they like pizza and hiring DVDs - and these weekends usually end up costing close to $100.

I asked the Bumsteads to send me a list of their current expenses, current debts and savings and their income (all of it).

The Bumsteads live in a suburban house they are renting, and trying to save for their own home. They own their car, a 10 year old sedan, the boat and boat trailer and their furniture.

"Help us please. We are working harder than ever and earning more than we ever have but no matter how hard we try we just don't get ahead. It's really getting both of us down. I spend hours sitting at the computer trying to figure out where the money is going and getting depressed. The bills are just mounting up and we are getting further and further behind. Please show us how we can get out of debt and start saving for a home of our own. I don't want to be renting when I retire!"

So lets meet the Bumsteads:

Blondie - a 48 year old wife and mother, working full time in an office a few suburbs away from home. Each weekday she leaves home at 8am, and drops the kids to school before heading off to start work at 9am. The kids get the bus home. She is supposed to finish work at 5pm, but at least 4 nights a week works over, and gets home between 6.30 - 7.30. Too tired to cook tea she picks up takeaway on way home or rings ahead for delivery, trying to choose the healthier options of charcoal chicken and salad or Chinese rather than pizza, fish and chips or burgers. She shops at her local supermarket in a big shopping centre on Saturday because she is simply too tired and busy with housework to be bothered going a little further to Aldi. Blondie has no organized menu plan or shopping list, rather just buys as she sees and thinks about groceries. There is no clothing plan for the family so she buys spontaneously or in an emergency shopping run when a garment is needed. There is no gift box or gift plan so again the shopping mall dash does the job, and poor Blondie ends up spending more than intended simply because there is no plan.

Dagwood - a 48 year old cabinet maker, employed by a local contractor, works 6 days a week, leaves home 7am , arrives back 6.30pm most days. Dagwood goes fishing to relax and this can cost $100 or more each time he goes, depending on how far he travels and whether or not he takes his little tinny. Towing the boat adds significantly to the cost of his hobby. He and Alexander often leave early on a Sunday morning to take the boat out and hopefully catch some fish. Otherwise he spends his time at home mowing the lawn or relaxing with the paper.

Alexander - in year 12, and the pressure is on. School supplies have been very expensive - Blondie forgot the second-hand book sale at the end of last year and so missed out on some cheaper textbooks. Alexander is on his Ls and gets his practice driving to school and each weekend when Dagwood takes him out for a drive. He spends most of his time studying or playing games on computer (online of course). Alexander often has friends over for gaming nights and Blondie has to feed them all, plus cover the extra electricity and broadband allowance that another 5 laptops use etc

Cookie - the social butterfly of the family. In year 8, Cookie is the most expensive member of the Bumstead family. She always needs cash for something - dancing, piano, school assignments/excursions/clothes/shoes/presents for friends/parties etc. Cookie Is generous to a fault and sending her parents broke with her generosity. She too often has friends over for weekend and holiday sleepovers - Blondie feeds them all - they like pizza and hiring DVDs - and these weekends usually end up costing close to $100.

I asked the Bumsteads to send me a list of their current expenses, current debts and savings and their income (all of it).

The Bumsteads live in a suburban house they are renting, and trying to save for their own home. They own their car, a 10 year old sedan, the boat and boat trailer and their furniture.

|

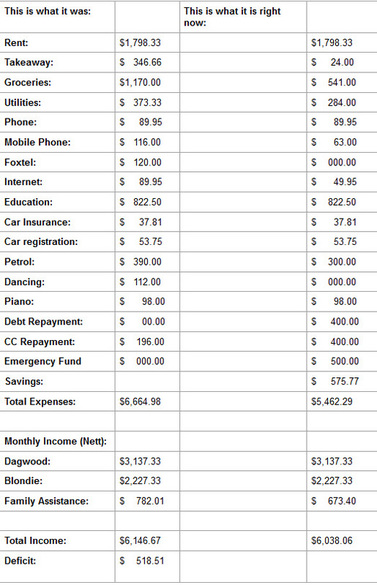

Monthly expenses:

Rent: Takeaway: Groceries: Utilities: Phone: Mobile phones: Foxtel: Internet: Education: Car Insurance: Car registration: Petrol: Dancing: Piano: Total known expenses: Monthly income (Nett): Dagwood: Blondie: Family Assistance: Total monthly income: Deficit: |

$1,798.33 $ 346.66 - a guestimate, takeaway at least three nights a week, sometimes more $1,170.00 - another guestimate, Blondie has idea of how much she really spends $ 373.33 $ 89.95 $ 116.00 $ 120.00 $ 89.95 $ 822.50 $ 37.81 $ 53.75 $ 390.00 $ 112.00 $ 98.00 $6,664.98 $3,137.33 $2,227.33 $ 782.01 (this includes rent allowance) $6,146.47 $ 518.51 |

Debt-wise the Bumsteads are carrying a heavy load. Their debt is all non-secured and even worse, they have nothing to show for it. They have one credit card with a current balance of $7,823.47, a school fee debt they owe from 2009 ($2, 263.00) and a private loan from Blondie's mother for $30,000 that they haven't started to pay back yet. Their total debt load is $40,086.47 and increasing daily with interest payments as they are struggling to make the minimum payment on the credit card debt each month (and it wasn't included in their list of monthly bills).

Dear Blondie and Dagwood,

You are carrying a heavy debt load and it is all unsecured. Even worse, you have nothing to show for this debt.

I noticed you didn't include the credit card repayment, the school fee debt or the loan from Blondie's mother in your monthly bills. These are debts, money owed, and they should be your first priority.

From what I can see you are living day to day, have no spending plan or savings. If an emergency crops up you will be even further behind.

Your tasks this month are to:

Task 1: Stop spending immediately on non-essentials.

Task 2: Track your spending - the four of you are to record every cent you spend. Milk, petrol, groceries, the credit card bill, the rent - record every cent you spend. Alexander and Cookie can track their spending too - they need to be accountable for how they spend the money you give them. Tracking spending is boring and monotonous, but after two weeks you'll see patterns begin to develop, after a month you'll be able to see at a glance exactly where your money is going. Be prepared to be shocked!

Task 3: Pantry, Fridge and Freezer inventory - this is a task to be done immediately. You need to know exactly what food you have and how much of it. Print off the inventory sheets on the Printables page, they'll make getting started easier.

Task 4: Menu Plan - Blondie, sit down with the family and come up with a menu plan, using only the ingredients you have, for one week. Then allocate Alexander and Cookie a night each to prepare and cook dinner. They are on holiday and more than old enough for this task. Let them use your recipe books or look up simple recipes in the Recipe File. At the end of the first week, sit down and come up with a menu plan for the rest of the month. Remember, you are not going to buy any ingredients, you must use up what you have on hand. Your meals may be unusual but you will have $1,170 extra in the bank at the end of the month.

Task 5: Collect bills, receipts, invoices, credit card statements and bank statements. Find twelve envelopes and label them January through December. Put the receipts, invoices etc into the right envelope. Hunt down as many as you can find, we need these to work on your Peace of Mind account.

Good luck with your tasks for the month. You have a lot to do, but it is all achievable. If you need inspiration, motivation or help, login and use the Search to find what you are looking for or ask the Forum members for suggestions. Remember, the first month is the hardest and the most satisfying.

Dear Blondie and Dagwood,

You are carrying a heavy debt load and it is all unsecured. Even worse, you have nothing to show for this debt.

I noticed you didn't include the credit card repayment, the school fee debt or the loan from Blondie's mother in your monthly bills. These are debts, money owed, and they should be your first priority.

From what I can see you are living day to day, have no spending plan or savings. If an emergency crops up you will be even further behind.

Your tasks this month are to:

Task 1: Stop spending immediately on non-essentials.

Task 2: Track your spending - the four of you are to record every cent you spend. Milk, petrol, groceries, the credit card bill, the rent - record every cent you spend. Alexander and Cookie can track their spending too - they need to be accountable for how they spend the money you give them. Tracking spending is boring and monotonous, but after two weeks you'll see patterns begin to develop, after a month you'll be able to see at a glance exactly where your money is going. Be prepared to be shocked!

Task 3: Pantry, Fridge and Freezer inventory - this is a task to be done immediately. You need to know exactly what food you have and how much of it. Print off the inventory sheets on the Printables page, they'll make getting started easier.

Task 4: Menu Plan - Blondie, sit down with the family and come up with a menu plan, using only the ingredients you have, for one week. Then allocate Alexander and Cookie a night each to prepare and cook dinner. They are on holiday and more than old enough for this task. Let them use your recipe books or look up simple recipes in the Recipe File. At the end of the first week, sit down and come up with a menu plan for the rest of the month. Remember, you are not going to buy any ingredients, you must use up what you have on hand. Your meals may be unusual but you will have $1,170 extra in the bank at the end of the month.

Task 5: Collect bills, receipts, invoices, credit card statements and bank statements. Find twelve envelopes and label them January through December. Put the receipts, invoices etc into the right envelope. Hunt down as many as you can find, we need these to work on your Peace of Mind account.

Good luck with your tasks for the month. You have a lot to do, but it is all achievable. If you need inspiration, motivation or help, login and use the Search to find what you are looking for or ask the Forum members for suggestions. Remember, the first month is the hardest and the most satisfying.

Meet the Bumsteads - Part 2

Dear Cath,

We have had some very hot days this month so the air conditioner and the fans have been running almost every day. I'm not looking forward to getting the electricity bill at the end of the month, although it should be partly paid with the automatic payments we have set up.

We have set up automatic payments for the electricity, gas, water and phone with money being moved each pay day into a bill account we have opened and we have arranged to have all the bills direct debited when they are due. I get the bill first so I'll be able to see if there is enough in the account to cover them, if not will adjust so each bill is paid on time. We are trying to not have any late fees at all this year.

Blondie gave cookie $20 and told her she was to buy all her stationery for school with it - she came home with just about everything she needs, and will use some things from last year - she was so proud of her bargain shopping and had a lot of fun going from store to store, comparing prices.

The other thing we have done this month is to change the kid's mobile plans - they are now on a set $30 credit, good for 12 months. The call/text costs are higher but their phones are supposed to be for emergencies only not socializing. This alone is going to save us $363 this year! If Alexander or Cookie run out of credit because of using their mobile phone for socializing then we have told them they can top up with their own money. Alexander hasn't used his phone in days!

Alexander picked up a few days casual work labouring for a family friend. It kept him busy, and saved us money as he wasn't going anywhere. When he did go out he used his own money. He's only working during the holidays, we would rather he concentrated on year 12 studies this year. This meant though that he was off kitchen duty, his hours were irregular and often he wasn't home until late.

Cookie picked up the slack though, and we have had some interesting meals. She has raided her mother's recipe books to find dishes she could make with the ingredients in the pantry or fridge. It has helped to cut the grocery bill down although Blondie says she'll need to do a big shop soon as we are running out of quite a few things.

Here's our first week's worth of tracking:

Jan 1: No money spent

Jan 2: No money spent

Jan 3: New lap top battery and power supply $184

Jan 4: $20 Cookie's school supplies (total was under $20, we let her keep the change)

Phone/Internet bill $269.37

Jan 5: Uniform shop $68

Coles $179.07

Petrol $61.15

Jan 6: No Money Spent

Jan 7: School shoes - $79.95

School bag $39.95

Groceries $62.13

Stationery $21.27

Mobile top up $29.00

As you can see we have cut our spending time right back. With everyone home we would normally have had lunches out, and at least two takeaway dinners as well as a few coffees etc during the week. It actually feels good to not be at the shops all the time and I know Dagwood and I haven't missed the Subway or McDonalds or even the large lattes from Muffin Break. The kids are still complaining about no soft drinks in the house but we are standing firm. It's good for our budget and good for their health.

We have started our Peace of Mind account and an Emergency Fund and they both have some money in them. We can't wait to see what improvements we can make to our finances in the next month, we already feel more confident and in control of our lives and our money. All the receipts, bills etc we could find are in the twelve envelopes ready for the next step.

Blondie & Dagwood

Dear Blondie and Dagwood,

You are on a roll! Well done with cutting back your time at the shops, it shows in your tracking and you must be feeling very proud.

The saving on mobile phone charges is great too. I suggest that you keep paying the $58 a month into your Peace of Mind account to build it up. Once you have it fully funded you can start putting that money into your Emergency Fund and watch it grow.

I am stunned though at your phone and Internet bill - that's huge! You need to spend some time researching alternate ISPs and plans, there has to be a cheaper option for you. You all have mobile phones and computers so the landline is obsolete. You might like to think about ditching the landline altogether and switching to VOIP for your phone calls if you can't manage to stay under your mobile plan caps. The quality of VOIP systems is improving all the time and you can have a phone, you don't need to just use a computer.

This month I would like you to concentrate on getting your Spending Plan up and running. Until you do this your Peace of Mind account and Emergency Fund won't be working to it's full potential, and your Emergency Fund won't grow quickly, and that's something you (or anyone else) just can't afford. Telling you to start an Emergency Fund while you are still in debt sounds like you are doing things backwards, but it's not, trust me!

I'd like you to start putting a regular amount each week into your Emergency Fund account. This account needs to be one you don't touch, so I'm hoping you've opened an account that doesn't have cards attached to it. You don't want to be able to get the money on a whim. This is emergency money: it's there to cover unexpected and unplanned for expenses. You should also include this as an expense in your fixed expenses part of your spending plan.

Your tasks this month are:

Task 1: Work on your Spending Plan.

Task 2: Spend some time researching for cheaper telephone and Internet. This is one area you can control, so take a few minutes to look at cheaper options. When you find suppliers that have better deals than you are currently on, pick up the phone and ring them. Ask lots of questions, including minimum contract times (if they are on a contract), any transfer fees (in case you move house), set-up or installation costs (and ask to have them waived if you agree to switch companies), excess download charges (yes, some companies still have them in place) and if there is a charge for having the bill direct debited (and if there is ask to have it waived if you switch). Also get a name and a contact number for the person you speak to and make lots and lots of notes. Ask them to email you variations to their regular contracts that they agree too as well so you have their offer in writing.

We have had some very hot days this month so the air conditioner and the fans have been running almost every day. I'm not looking forward to getting the electricity bill at the end of the month, although it should be partly paid with the automatic payments we have set up.

We have set up automatic payments for the electricity, gas, water and phone with money being moved each pay day into a bill account we have opened and we have arranged to have all the bills direct debited when they are due. I get the bill first so I'll be able to see if there is enough in the account to cover them, if not will adjust so each bill is paid on time. We are trying to not have any late fees at all this year.

Blondie gave cookie $20 and told her she was to buy all her stationery for school with it - she came home with just about everything she needs, and will use some things from last year - she was so proud of her bargain shopping and had a lot of fun going from store to store, comparing prices.

The other thing we have done this month is to change the kid's mobile plans - they are now on a set $30 credit, good for 12 months. The call/text costs are higher but their phones are supposed to be for emergencies only not socializing. This alone is going to save us $363 this year! If Alexander or Cookie run out of credit because of using their mobile phone for socializing then we have told them they can top up with their own money. Alexander hasn't used his phone in days!

Alexander picked up a few days casual work labouring for a family friend. It kept him busy, and saved us money as he wasn't going anywhere. When he did go out he used his own money. He's only working during the holidays, we would rather he concentrated on year 12 studies this year. This meant though that he was off kitchen duty, his hours were irregular and often he wasn't home until late.

Cookie picked up the slack though, and we have had some interesting meals. She has raided her mother's recipe books to find dishes she could make with the ingredients in the pantry or fridge. It has helped to cut the grocery bill down although Blondie says she'll need to do a big shop soon as we are running out of quite a few things.

Here's our first week's worth of tracking:

Jan 1: No money spent

Jan 2: No money spent

Jan 3: New lap top battery and power supply $184

Jan 4: $20 Cookie's school supplies (total was under $20, we let her keep the change)

Phone/Internet bill $269.37

Jan 5: Uniform shop $68

Coles $179.07

Petrol $61.15

Jan 6: No Money Spent

Jan 7: School shoes - $79.95

School bag $39.95

Groceries $62.13

Stationery $21.27

Mobile top up $29.00

As you can see we have cut our spending time right back. With everyone home we would normally have had lunches out, and at least two takeaway dinners as well as a few coffees etc during the week. It actually feels good to not be at the shops all the time and I know Dagwood and I haven't missed the Subway or McDonalds or even the large lattes from Muffin Break. The kids are still complaining about no soft drinks in the house but we are standing firm. It's good for our budget and good for their health.

We have started our Peace of Mind account and an Emergency Fund and they both have some money in them. We can't wait to see what improvements we can make to our finances in the next month, we already feel more confident and in control of our lives and our money. All the receipts, bills etc we could find are in the twelve envelopes ready for the next step.

Blondie & Dagwood

Dear Blondie and Dagwood,

You are on a roll! Well done with cutting back your time at the shops, it shows in your tracking and you must be feeling very proud.

The saving on mobile phone charges is great too. I suggest that you keep paying the $58 a month into your Peace of Mind account to build it up. Once you have it fully funded you can start putting that money into your Emergency Fund and watch it grow.

I am stunned though at your phone and Internet bill - that's huge! You need to spend some time researching alternate ISPs and plans, there has to be a cheaper option for you. You all have mobile phones and computers so the landline is obsolete. You might like to think about ditching the landline altogether and switching to VOIP for your phone calls if you can't manage to stay under your mobile plan caps. The quality of VOIP systems is improving all the time and you can have a phone, you don't need to just use a computer.

This month I would like you to concentrate on getting your Spending Plan up and running. Until you do this your Peace of Mind account and Emergency Fund won't be working to it's full potential, and your Emergency Fund won't grow quickly, and that's something you (or anyone else) just can't afford. Telling you to start an Emergency Fund while you are still in debt sounds like you are doing things backwards, but it's not, trust me!

I'd like you to start putting a regular amount each week into your Emergency Fund account. This account needs to be one you don't touch, so I'm hoping you've opened an account that doesn't have cards attached to it. You don't want to be able to get the money on a whim. This is emergency money: it's there to cover unexpected and unplanned for expenses. You should also include this as an expense in your fixed expenses part of your spending plan.

Your tasks this month are:

Task 1: Work on your Spending Plan.

Task 2: Spend some time researching for cheaper telephone and Internet. This is one area you can control, so take a few minutes to look at cheaper options. When you find suppliers that have better deals than you are currently on, pick up the phone and ring them. Ask lots of questions, including minimum contract times (if they are on a contract), any transfer fees (in case you move house), set-up or installation costs (and ask to have them waived if you agree to switch companies), excess download charges (yes, some companies still have them in place) and if there is a charge for having the bill direct debited (and if there is ask to have it waived if you switch). Also get a name and a contact number for the person you speak to and make lots and lots of notes. Ask them to email you variations to their regular contracts that they agree too as well so you have their offer in writing.

Meet the Bumsteads - Part 3

Dear Cath,

We think we've survived February OK. We took up the Spending Freeze challenge and with the occasional slip up we pretty much stopped spending completely except for the rent, petrol, phone bills and topping up the milk and vegetables. I even put off paying Cookie's dancing fees until March. I just told the teacher that we were in a Spending Freeze challenge and asked if could she please wait until 1st March to be paid and she was OK with that.

The pantry is bare and the freezer is almost empty but now Blondie says she can get in and really clean and organize and write up a real shopping list. I expect the first grocery bill will be huge because she's planning to stock up for a month. After reading Helen's tip about shopping once a month we have decided to give it a go and see if we can cut even more off the grocery bill.

You will be pleased to hear the we have switched the phone and Internet and are saving $160 a month that is going straight into our Emergency Fund. We would really like to have it up to six months of wages before we start saving for a house.

The automatic payments we have set up are working really well, better than we thought they would. We have had a water bill and we only have to pay $7.80! The rest was in the bill account. I have upped the amount put into the water category this month by $1.95 a week so hopefully next quarter we won't have to pay anything!

Blondie and Dagwood

Dear Blondie and Dagwood

Congratulations on the saving on your phone and Internet, that's almost $2,000 a year! And don't forget that it isn't saved until it is in the bank. I suggest you increase your direct deposit into your Emergency Fund straight away. Money has a way of disappearing if it's not allocated immediately.

I smiled when I read what you did with Cookie's dancing fees. Did you explain why you were on a Spending Freeze for February? I'd love to know what she thought.

Once a month shopping is a great way to save money and time. It doesn't take that much longer to throw a month's worth of groceries into the trolley and get through the checkout than it does a weeks. And with one visit to the supermarket you are saving so much time not to mention petrol and spur of the moment purchases.

Blondie will find the first month's grocery list will be the big one, especially as she is stocking up the pantry. After that it settles into a regular price range, going up or down slightly depending on what irregular things you buy. By irregular I mean things like herbs and spices, light bulbs etc, the things you use but don't buy every week.

You haven't mentioned your Spending Plan. I do hope you have worked it out. A Spending Plan is an essential budgeting tool. It shows you exactly how much you need to put into your Peace of Mind account each pay period to cover the bills, how much you are really spending and how much you are really saving.

Your tasks for this month are:

Task 1: Finalize your spending plan. And send copy through to me.

Task 2: Set up a Payment Push for your debts. You still owe on school fees, the credit card and the loan from Blondie's mother. I suggest your Payment Push order is school fees, credit card, Blondie's mother. You already have $363 a year (from the kid's mobile phone plan change) that you an add to your Payment Push. Now you need to add any extra money you have each month. Even the loose change under the sofa can go to the Payment Push. Getting those debts paid off in double quick time will see you in your own home so much faster.

We think we've survived February OK. We took up the Spending Freeze challenge and with the occasional slip up we pretty much stopped spending completely except for the rent, petrol, phone bills and topping up the milk and vegetables. I even put off paying Cookie's dancing fees until March. I just told the teacher that we were in a Spending Freeze challenge and asked if could she please wait until 1st March to be paid and she was OK with that.

The pantry is bare and the freezer is almost empty but now Blondie says she can get in and really clean and organize and write up a real shopping list. I expect the first grocery bill will be huge because she's planning to stock up for a month. After reading Helen's tip about shopping once a month we have decided to give it a go and see if we can cut even more off the grocery bill.

You will be pleased to hear the we have switched the phone and Internet and are saving $160 a month that is going straight into our Emergency Fund. We would really like to have it up to six months of wages before we start saving for a house.

The automatic payments we have set up are working really well, better than we thought they would. We have had a water bill and we only have to pay $7.80! The rest was in the bill account. I have upped the amount put into the water category this month by $1.95 a week so hopefully next quarter we won't have to pay anything!

Blondie and Dagwood

Dear Blondie and Dagwood

Congratulations on the saving on your phone and Internet, that's almost $2,000 a year! And don't forget that it isn't saved until it is in the bank. I suggest you increase your direct deposit into your Emergency Fund straight away. Money has a way of disappearing if it's not allocated immediately.

I smiled when I read what you did with Cookie's dancing fees. Did you explain why you were on a Spending Freeze for February? I'd love to know what she thought.

Once a month shopping is a great way to save money and time. It doesn't take that much longer to throw a month's worth of groceries into the trolley and get through the checkout than it does a weeks. And with one visit to the supermarket you are saving so much time not to mention petrol and spur of the moment purchases.

Blondie will find the first month's grocery list will be the big one, especially as she is stocking up the pantry. After that it settles into a regular price range, going up or down slightly depending on what irregular things you buy. By irregular I mean things like herbs and spices, light bulbs etc, the things you use but don't buy every week.

You haven't mentioned your Spending Plan. I do hope you have worked it out. A Spending Plan is an essential budgeting tool. It shows you exactly how much you need to put into your Peace of Mind account each pay period to cover the bills, how much you are really spending and how much you are really saving.

Your tasks for this month are:

Task 1: Finalize your spending plan. And send copy through to me.

Task 2: Set up a Payment Push for your debts. You still owe on school fees, the credit card and the loan from Blondie's mother. I suggest your Payment Push order is school fees, credit card, Blondie's mother. You already have $363 a year (from the kid's mobile phone plan change) that you an add to your Payment Push. Now you need to add any extra money you have each month. Even the loose change under the sofa can go to the Payment Push. Getting those debts paid off in double quick time will see you in your own home so much faster.

Meet the Bumsteads - Part 4

Dear Cath,

March has been a tough month! So many things have been going on and everything has cost money - money that we haven't saved yet in our Peace of Mind account or Emergency Fund. We have been taking money from all over the place to keep up so some of our categories are looking rather sad. BUT we haven't used credit once and we are both really happy about that.

Blondie's car needed two new tyres and we didn't have enough in the car category so we had to move money from Christmas and School to cover the cost. Now they are both empty and we have to start again. Do we try and make up the money we have used or do we just start from $0 again and adjust the budget for those categories?

Because of the money shuffling Blondie hasn't done a proper grocery shop yet so the pantry and fridge are still quite bare. Blondie must be a magician because we are eating better than ever and last night she showed me a jar with $90 in it. She told me it was the grocery slush fund ala Cheapskates and that was the money she was going to use to do the big shop. I can't tell you how proud I am of her, we have never, ever had grocery money over before.

It looks like we have wasted money on some of Cookie's activities. She has changed her mind and doesn't want to continue with dancing. We had only paid part of the fees but we had bought her new tights and shoes. If only she had changed her mind three weeks earlier.

I've been reading up on veggie gardens and have decided to give it a go. I have all winter to get the beds ready. My plan is to not have to buy vegetables at all, except for potatoes, over the summer next year. We have also started a real compost heap too, to help improve the soil. We are saving our egg cartons and toilet rolls to use as seed starters so we don't have to buy seedlings at four times the price of a packet of seeds.

I have attached our Spending Plan (at last). If you can see any gaps please, please tell us so we can get them fixed.

Please wish Julie and the rest of the team a happy Easter from us. We can't wait to try the homemade Easter eggs Cookie made on Sunday morning.

Dagwood.

Dear Dagwood,

Life happens! That's why you have Peace of Mind and Emergency Funds. Think of the extra debt you would have if you hadn't started your Peace of Mind account in January. I suggest you keep funding each category as per your Spending Plan (and thank you for that, it's looking good). When the Car Maintenance category reaches it's budget for the year you can put the excess into the Christmas and School categories. This will bring them back up to budget by the end of the year.

Way to go Blondie too. I love my grocery slush fund. It's so good to have cash available to stock up on those really good grocery deals without having to cut the grocery budget. Sometimes it can build up for quite a few weeks before a really great deal comes along, other times Blondie will be using it every week to stock up.

Can you sell Cookie's tights and dance shoes? IF they are almost brand new you should be able to get at least half your money back. And have you thought about making Cookie accountable for the expense? Starting something and letting you spend money, especially when she is old enough to understand that money is tight, isn't really fair or respectful to you or her dance teacher. Perhaps she can work off the difference between what they cost and what you can sell them for.

Dagwood don't wait until Spring to start your veggie garden. There are plenty of veggies you can be planting right now for winter and spring crops. Peas, turnips, cauliflowers, beetroot, silverbeet, spinach, lettuce, broccoli, even potatoes can all be planted now in your area. You live in a frost-free zone so get busy planting and in a few weeks you'll be able to start eating your own produce. Nothing tastes as good as food you have grown yourself.

Happy Easter to you, Blondie and the kids from all of us too.

March has been a tough month! So many things have been going on and everything has cost money - money that we haven't saved yet in our Peace of Mind account or Emergency Fund. We have been taking money from all over the place to keep up so some of our categories are looking rather sad. BUT we haven't used credit once and we are both really happy about that.

Blondie's car needed two new tyres and we didn't have enough in the car category so we had to move money from Christmas and School to cover the cost. Now they are both empty and we have to start again. Do we try and make up the money we have used or do we just start from $0 again and adjust the budget for those categories?

Because of the money shuffling Blondie hasn't done a proper grocery shop yet so the pantry and fridge are still quite bare. Blondie must be a magician because we are eating better than ever and last night she showed me a jar with $90 in it. She told me it was the grocery slush fund ala Cheapskates and that was the money she was going to use to do the big shop. I can't tell you how proud I am of her, we have never, ever had grocery money over before.

It looks like we have wasted money on some of Cookie's activities. She has changed her mind and doesn't want to continue with dancing. We had only paid part of the fees but we had bought her new tights and shoes. If only she had changed her mind three weeks earlier.

I've been reading up on veggie gardens and have decided to give it a go. I have all winter to get the beds ready. My plan is to not have to buy vegetables at all, except for potatoes, over the summer next year. We have also started a real compost heap too, to help improve the soil. We are saving our egg cartons and toilet rolls to use as seed starters so we don't have to buy seedlings at four times the price of a packet of seeds.

I have attached our Spending Plan (at last). If you can see any gaps please, please tell us so we can get them fixed.

Please wish Julie and the rest of the team a happy Easter from us. We can't wait to try the homemade Easter eggs Cookie made on Sunday morning.

Dagwood.

Dear Dagwood,

Life happens! That's why you have Peace of Mind and Emergency Funds. Think of the extra debt you would have if you hadn't started your Peace of Mind account in January. I suggest you keep funding each category as per your Spending Plan (and thank you for that, it's looking good). When the Car Maintenance category reaches it's budget for the year you can put the excess into the Christmas and School categories. This will bring them back up to budget by the end of the year.

Way to go Blondie too. I love my grocery slush fund. It's so good to have cash available to stock up on those really good grocery deals without having to cut the grocery budget. Sometimes it can build up for quite a few weeks before a really great deal comes along, other times Blondie will be using it every week to stock up.

Can you sell Cookie's tights and dance shoes? IF they are almost brand new you should be able to get at least half your money back. And have you thought about making Cookie accountable for the expense? Starting something and letting you spend money, especially when she is old enough to understand that money is tight, isn't really fair or respectful to you or her dance teacher. Perhaps she can work off the difference between what they cost and what you can sell them for.

Dagwood don't wait until Spring to start your veggie garden. There are plenty of veggies you can be planting right now for winter and spring crops. Peas, turnips, cauliflowers, beetroot, silverbeet, spinach, lettuce, broccoli, even potatoes can all be planted now in your area. You live in a frost-free zone so get busy planting and in a few weeks you'll be able to start eating your own produce. Nothing tastes as good as food you have grown yourself.

Happy Easter to you, Blondie and the kids from all of us too.

Meet the Bumsteads - Part 5

Dear Cath,

April is almost over thank goodness. I feel like it's been two steps forward, three steps back this month.

All our bills have been bigger than anticipated and with winter coming on the gas and electricity bills are just going to get even higher and we are not sure we can save any more in those two categories.

Thanks for the suggestion to sell Cookie's dancing tights and shoes. They were almost brand new so we were able to get back just over half the cost and Cookie is working off the rest helping Blondie with the cleaning on a Saturday morning.

The company Blondie works for is downsizing, an effect from the GFC that has finally hit. They have told her that she will still have a job but it will be only 20 hours a week which means she loses half her income. She's looking for other work but we have been considering whether or not we can manage on her part-time wage and my income. On paper it looks like we can, what do you think?

Blondie thinks that if she is able to spend more of her time at home, then we can grow more of our own food - I have to tell you your enthusiasm for that is contagious, we are loving the veggie garden - and cook more from scratch, shop around for specials and not be tempted to spend lunchtime window shopping.

I would love for her to stay home, we never intended for her to work full-time outside our home. My only concern is my income, my overtime varies a lot.

We managed to get away for a couple of days over Easter and it was lovely. I took the boat out and caught enough fish to keep us in fish dinners for a couple of months, best catch I have had in a long time. We "borrowed" my brother-in-laws caravan for accommodation, so we only had to pay the overnight fees for the caravan park, $24 each night for the four of us. We took all our own food and drink and books to read. The only other expense we had was the fuel for the boat and the petrol in the car, so quite a cheap weekend away considering it was Easter.

Cookie loved the idea of getting a job. She has visions of having lots and lots of money to spend. We plan on her living on the 10-10-80 plan and we intend to charge her board too out of her eighty percent to live on. Hopefully she'll learn young and never end up like we have.

Well I better get going, can't wait to hear from you,

Dagwood.

Dear Blondie and Dagwood,

I am so envious of your Easter holiday. Days spent reading and fishing sound like bliss and I hope you all came home refreshed and relaxed.

What to do about over budget utility bills? Well you can keep looking for ways to cut usage. Make sure all unused appliances are turned off at the wall. Switch to low voltage light bulbs, pull out some throws and wear socks and slippers before putting on the heater. Set the thermostat to 18 - 20 degrees. Close drapes at dusk to keep warm air in. Open them in the morning to let the sun warm the house. Keep hot water use to the mornings and evenings and turn the hot water service off during the day (it won't cool right down and doesn't take long to heat up again).

I think you know all the things you should be doing, it's actually doing them that can be the stumbling block. Challenge the family to using less and less electricity and gas each day. Start by taking a meter reading at the same time each day and see how much you use (or don't) and watch the bill drop. Being aware of how much power you are using really helps to cut the bill.

I have gone over your figures again and I believe that if you stick like glue to your Spending Plan and Payment Push everything will be OK, even on Blondie's reduced income. If you lose all of Blondie's income it will slow down your debt repayment and ability to save drastically. Take another look at your Payment Push and rework it on your reduced income. How many years does it add before you are debt free? Can you all hold out that long for Blondie to retire?

I would really like to see you have more in your Peace of Mind Account and at least half your debt paid off before Blondie gives up work entirely but if you keep going the way you are then that won't be long, perhaps another eighteen months at the most.

It's important that you have the money to cover contingencies as they crop up. If you don't you'll be tempted to whip out the credit card or borrow some more from Blondie's mother.

The other thing to remember is you want to save for a home of your own. If Blondie becomes a full-time stay-at-home wife and mother will you be able to keep saving? I appreciate how hard it is for her to keep working and still run a home and family. I have been there, doing just that and I know how tired she must feel at times.

If you really want to be debt free and have a home of your own in the foreseeable future then Blondie's income is needed, even if it is part-time. Think of this time in relation to your whole lives. In the grand scheme of things it is just a little while, a tiny portion of time, to set yourselves up for many, many years to come.

The choice is yours. You will manage on Blondie's reduced hours, you'll just need to watch every cent you spend. You will also manage if Blondie retires, but your chances of owning your own home and being debt free any time soon are slim.

I am so glad you have made Cookie accountable and so proud that she has accepted that she has a responsibility to make good on the money wasted. That's a great lesson for anyone to learn.

How is that veggie garden going? Send me some pictures, I can't wait to see what you have done. I agree that growing your own food is contagious. There is nothing quite so satisfying as knowing you are eating food you have grown yourself.

I am not going to set you any specific tasks this month. I think that you have a lot to think about and work through and some big decisions to make so you don't need any more pressure from me.

Remember I am just an email or phone call away if you get stuck.

Have a great month.

April is almost over thank goodness. I feel like it's been two steps forward, three steps back this month.

All our bills have been bigger than anticipated and with winter coming on the gas and electricity bills are just going to get even higher and we are not sure we can save any more in those two categories.

Thanks for the suggestion to sell Cookie's dancing tights and shoes. They were almost brand new so we were able to get back just over half the cost and Cookie is working off the rest helping Blondie with the cleaning on a Saturday morning.

The company Blondie works for is downsizing, an effect from the GFC that has finally hit. They have told her that she will still have a job but it will be only 20 hours a week which means she loses half her income. She's looking for other work but we have been considering whether or not we can manage on her part-time wage and my income. On paper it looks like we can, what do you think?

Blondie thinks that if she is able to spend more of her time at home, then we can grow more of our own food - I have to tell you your enthusiasm for that is contagious, we are loving the veggie garden - and cook more from scratch, shop around for specials and not be tempted to spend lunchtime window shopping.

I would love for her to stay home, we never intended for her to work full-time outside our home. My only concern is my income, my overtime varies a lot.

We managed to get away for a couple of days over Easter and it was lovely. I took the boat out and caught enough fish to keep us in fish dinners for a couple of months, best catch I have had in a long time. We "borrowed" my brother-in-laws caravan for accommodation, so we only had to pay the overnight fees for the caravan park, $24 each night for the four of us. We took all our own food and drink and books to read. The only other expense we had was the fuel for the boat and the petrol in the car, so quite a cheap weekend away considering it was Easter.

Cookie loved the idea of getting a job. She has visions of having lots and lots of money to spend. We plan on her living on the 10-10-80 plan and we intend to charge her board too out of her eighty percent to live on. Hopefully she'll learn young and never end up like we have.

Well I better get going, can't wait to hear from you,

Dagwood.

Dear Blondie and Dagwood,

I am so envious of your Easter holiday. Days spent reading and fishing sound like bliss and I hope you all came home refreshed and relaxed.

What to do about over budget utility bills? Well you can keep looking for ways to cut usage. Make sure all unused appliances are turned off at the wall. Switch to low voltage light bulbs, pull out some throws and wear socks and slippers before putting on the heater. Set the thermostat to 18 - 20 degrees. Close drapes at dusk to keep warm air in. Open them in the morning to let the sun warm the house. Keep hot water use to the mornings and evenings and turn the hot water service off during the day (it won't cool right down and doesn't take long to heat up again).

I think you know all the things you should be doing, it's actually doing them that can be the stumbling block. Challenge the family to using less and less electricity and gas each day. Start by taking a meter reading at the same time each day and see how much you use (or don't) and watch the bill drop. Being aware of how much power you are using really helps to cut the bill.

I have gone over your figures again and I believe that if you stick like glue to your Spending Plan and Payment Push everything will be OK, even on Blondie's reduced income. If you lose all of Blondie's income it will slow down your debt repayment and ability to save drastically. Take another look at your Payment Push and rework it on your reduced income. How many years does it add before you are debt free? Can you all hold out that long for Blondie to retire?

I would really like to see you have more in your Peace of Mind Account and at least half your debt paid off before Blondie gives up work entirely but if you keep going the way you are then that won't be long, perhaps another eighteen months at the most.

It's important that you have the money to cover contingencies as they crop up. If you don't you'll be tempted to whip out the credit card or borrow some more from Blondie's mother.

The other thing to remember is you want to save for a home of your own. If Blondie becomes a full-time stay-at-home wife and mother will you be able to keep saving? I appreciate how hard it is for her to keep working and still run a home and family. I have been there, doing just that and I know how tired she must feel at times.

If you really want to be debt free and have a home of your own in the foreseeable future then Blondie's income is needed, even if it is part-time. Think of this time in relation to your whole lives. In the grand scheme of things it is just a little while, a tiny portion of time, to set yourselves up for many, many years to come.

The choice is yours. You will manage on Blondie's reduced hours, you'll just need to watch every cent you spend. You will also manage if Blondie retires, but your chances of owning your own home and being debt free any time soon are slim.

I am so glad you have made Cookie accountable and so proud that she has accepted that she has a responsibility to make good on the money wasted. That's a great lesson for anyone to learn.

How is that veggie garden going? Send me some pictures, I can't wait to see what you have done. I agree that growing your own food is contagious. There is nothing quite so satisfying as knowing you are eating food you have grown yourself.

I am not going to set you any specific tasks this month. I think that you have a lot to think about and work through and some big decisions to make so you don't need any more pressure from me.

Remember I am just an email or phone call away if you get stuck.

Have a great month.

Meet the Bumsteads - Part 6

Dear Cath,

It's Blondie here. May is over and would you believe we have survived it, with money still in our Emergency Fund and with all the things that went wrong!

We had to spend money on car repairs - $900 exactly! I started working part-time, only twenty hours a week, so my income has halved and to top it off Dagwood managed to get a speeding ticket, $140!

I am surprised that I am not more stressed over the money situation, but every time I look at the Spending Plan and the Peace of Mind account I actually relax. For the first time in our married lives I am able to pay most of the bills the day they arrive, rather than waiting for the final notice and paying a late fee.

Now I have more time at home and we are all enjoying it, I am much nicer now I don't have to race around to get things done. Because I am happier everyone else is too, so the household is running smoothly. I have started to really enjoy cooking again, and have pulled out my recipes books. Cookie and I go through them, choose a recipe and then check the pantry and freezer inventories to see if we have the ingredients to make it. If we do, then we give it a go. But this is what I am most proud of: if we don't have the right ingredients, we look for substitutes (Google is great for this), if we can't find substitutes we choose another recipe. Five months ago I would have nipped to the shops straight away to buy everything. What a lot of money I used to waste. Now I am saving it.

That's probably common sense for most people, but I honestly never thought of checking, substituting or changing my mind. I am so glad Dagwood wrote to you and asked for help.

We picked up a trailer load of fire wood, and it's already seasoned, and we can go back and get at least another load so that will save us around $400 in heating this winter. It was actually fun, we all went and picked up the wood. I took a thermos and a picnic so we stopped and enjoyed lunch before we drove home. The total cost - less than half a tank of fuel, so about $30 for about $260 worth of firewood.

It's been great, we haven't had the ducted heating on at all, even in the mornings and I haven't been tempted to use the dryer either. The clothes dry next to the stove beautifully, often in just a couple of hours so I expect the electricity bill will be cheaper this winter too.

Cookie is loving her job. She works Friday nights till 9pm and Saturday from 9am - 4pm. We took her and opened a savings account and an everyday account for her. Her pay goes straight into the savings account and we set up a transfer of spending money into her everyday account. Right now she is spending all her everyday money, but I think she is realising it's not quite as easy come, easy go as she thought now she is the one working for it. We also charge her $20 a week board. I'm not sure what we'll do with it yet, but I think it's a good habit for her to get into.

Now I have more time I have doubled the size of the veggie garden. I read on your blog about what you have planted and kind of copied you, except I am not sure we would eat turnip - yuk - so I put more peas and beans in and cabbage, cauliflower and broccoli. They are doing really well, and I have tomato seeds ready to plant, just waiting until July/August to get them started for the summer.

Well that's about all for this month, as you can see our spending is getting lower and lower (except for the unexpected bills) and I am honestly surprised to find that we haven't really missed anything, even eating out.

Blondie

Dear Blondie,

You have no idea how proud I am of you right now. Talk about a complete change of attitude and in just a few short months. When Dagwood first came to me I wasn't sure we would be able to work together, you really weren't convinced you could change your habits and I think you were absolutely not going to become a Cheapskate. Look at you now - cooking from scratch, growing your own food, working part-time, with a Spending Plan and Emergency Fund.

I am concerned about you losing half your income. This will stretch out the time until you are debt free and saving for your own home. I am so proud of you for managing right now, but I still think that if you could work full-time for just another seventeen months then you will be debt free and going part-time will be a great reward. As it is now, providing Murphy doesn't visit you again, it is going to be almost three years until you clear your debt.

Perhaps revisit your figures. Look at how the debt will reduce if you throw all your extra money at it (tax refunds, unexpected gifts, the $1 you find in the washing machine). Will that make a significant difference? If it does, then I am happy for you to stay on part time work.

You are into your sixth month of the budget renovation, so it is time to sit down and review your plans and the results. This is your first task for the month.

The second task is to get all the tax information ready so you can lodge your returns as soon as possible. The earlier you lodge, the earlier you'll get your return and be able to pay it off your debt, reducing the interest and the time you have left on your Payment Push.

I am so very envious of your free, already seasoned firewood. What a saving and what a luxury. I hope you enjoy your evenings by the fire.

Remember, stick to the plan and if you feel like giving up login and visit the Member's Forum. We are all here to cheer you on.

It's Blondie here. May is over and would you believe we have survived it, with money still in our Emergency Fund and with all the things that went wrong!

We had to spend money on car repairs - $900 exactly! I started working part-time, only twenty hours a week, so my income has halved and to top it off Dagwood managed to get a speeding ticket, $140!

I am surprised that I am not more stressed over the money situation, but every time I look at the Spending Plan and the Peace of Mind account I actually relax. For the first time in our married lives I am able to pay most of the bills the day they arrive, rather than waiting for the final notice and paying a late fee.

Now I have more time at home and we are all enjoying it, I am much nicer now I don't have to race around to get things done. Because I am happier everyone else is too, so the household is running smoothly. I have started to really enjoy cooking again, and have pulled out my recipes books. Cookie and I go through them, choose a recipe and then check the pantry and freezer inventories to see if we have the ingredients to make it. If we do, then we give it a go. But this is what I am most proud of: if we don't have the right ingredients, we look for substitutes (Google is great for this), if we can't find substitutes we choose another recipe. Five months ago I would have nipped to the shops straight away to buy everything. What a lot of money I used to waste. Now I am saving it.

That's probably common sense for most people, but I honestly never thought of checking, substituting or changing my mind. I am so glad Dagwood wrote to you and asked for help.

We picked up a trailer load of fire wood, and it's already seasoned, and we can go back and get at least another load so that will save us around $400 in heating this winter. It was actually fun, we all went and picked up the wood. I took a thermos and a picnic so we stopped and enjoyed lunch before we drove home. The total cost - less than half a tank of fuel, so about $30 for about $260 worth of firewood.

It's been great, we haven't had the ducted heating on at all, even in the mornings and I haven't been tempted to use the dryer either. The clothes dry next to the stove beautifully, often in just a couple of hours so I expect the electricity bill will be cheaper this winter too.

Cookie is loving her job. She works Friday nights till 9pm and Saturday from 9am - 4pm. We took her and opened a savings account and an everyday account for her. Her pay goes straight into the savings account and we set up a transfer of spending money into her everyday account. Right now she is spending all her everyday money, but I think she is realising it's not quite as easy come, easy go as she thought now she is the one working for it. We also charge her $20 a week board. I'm not sure what we'll do with it yet, but I think it's a good habit for her to get into.

Now I have more time I have doubled the size of the veggie garden. I read on your blog about what you have planted and kind of copied you, except I am not sure we would eat turnip - yuk - so I put more peas and beans in and cabbage, cauliflower and broccoli. They are doing really well, and I have tomato seeds ready to plant, just waiting until July/August to get them started for the summer.

Well that's about all for this month, as you can see our spending is getting lower and lower (except for the unexpected bills) and I am honestly surprised to find that we haven't really missed anything, even eating out.

Blondie

Dear Blondie,

You have no idea how proud I am of you right now. Talk about a complete change of attitude and in just a few short months. When Dagwood first came to me I wasn't sure we would be able to work together, you really weren't convinced you could change your habits and I think you were absolutely not going to become a Cheapskate. Look at you now - cooking from scratch, growing your own food, working part-time, with a Spending Plan and Emergency Fund.

I am concerned about you losing half your income. This will stretch out the time until you are debt free and saving for your own home. I am so proud of you for managing right now, but I still think that if you could work full-time for just another seventeen months then you will be debt free and going part-time will be a great reward. As it is now, providing Murphy doesn't visit you again, it is going to be almost three years until you clear your debt.

Perhaps revisit your figures. Look at how the debt will reduce if you throw all your extra money at it (tax refunds, unexpected gifts, the $1 you find in the washing machine). Will that make a significant difference? If it does, then I am happy for you to stay on part time work.

You are into your sixth month of the budget renovation, so it is time to sit down and review your plans and the results. This is your first task for the month.

The second task is to get all the tax information ready so you can lodge your returns as soon as possible. The earlier you lodge, the earlier you'll get your return and be able to pay it off your debt, reducing the interest and the time you have left on your Payment Push.

I am so very envious of your free, already seasoned firewood. What a saving and what a luxury. I hope you enjoy your evenings by the fire.

Remember, stick to the plan and if you feel like giving up login and visit the Member's Forum. We are all here to cheer you on.

Meet the Bumsteads - Part 7

Dear Cath,

We don't have much to report this month - isn't that fantastic? Life is sailing along very smoothly. Bills are being paid, we haven't had a single "emergency" crop up and we are getting on really well on Blondie's half pay.

It's hard to believe that less than a year ago we were afraid to open the mail for fear of another bill we wouldn't be able to pay.

Don't get us wrong, we know we still have a long way to go and a lot of debt to repay, but it feels so good having a plan to work to. The extra time to get out of debt we think is worth it. We know we'll pay a bit more but that's our pay off for a happier and more contented family. And we really think the kids need us right now, so having Blondie home with them more is a good thing. It won't be long and they'll be gone and living their own lives.

We even have all our tax info ready to go to the tax man (as per your instructions). and we've even booked the appointment (8pm on 6th July) because we are so organized. This is a genuine first for us, we are usually still scrabbling around at the end of August in a panic.

Life in the Bumstead household is great at the moment. Don't get us wrong, we still have our ups and downs but it's so much better than it was. Even the kids are happier and calmer, and we thought we had kept our money worries away from them. Turns out they knew something was up, and didn't want to upset us by letting on. No wonder we were all stressed out.

They are both doing their best to help save money and Cookie has become very good at finding the specials and bargains for things we need. She seems to have a knack for sniffing out a good deal, especially on clothes and eating out.

That's about it from the Bumsteads this month, not much to report at all.

Blondie and Dagwood

Dear Blondie and Dagwood,

I just loved hearing you didn't have much to report, that really is fantastic.

Look how far you've come in just six months, you have accomplished quite a lot:

Give yourselves a pat on the back for all you have accomplished. And then make a commitment to stick to your plan. It's easy to get sidetracked by a little success and fall back into those bad old habits. Reward yourselves with a treat, perhaps dinner and a movie or a weekend away with the boat, fishing. And then it's back to business.

You have a goal to be debt free and to buy your own home so you need to stay focussed. I know you can do it, you are pulling together as a family and that makes a big challenge so much easier.

How is the veggie garden going? You didn't mention it this month. Hope it's still feeding you all, let me know what you're growing.

I am so very pleased for you all and I can't wait until you tell me the last debt is paid.

We don't have much to report this month - isn't that fantastic? Life is sailing along very smoothly. Bills are being paid, we haven't had a single "emergency" crop up and we are getting on really well on Blondie's half pay.

It's hard to believe that less than a year ago we were afraid to open the mail for fear of another bill we wouldn't be able to pay.

Don't get us wrong, we know we still have a long way to go and a lot of debt to repay, but it feels so good having a plan to work to. The extra time to get out of debt we think is worth it. We know we'll pay a bit more but that's our pay off for a happier and more contented family. And we really think the kids need us right now, so having Blondie home with them more is a good thing. It won't be long and they'll be gone and living their own lives.

We even have all our tax info ready to go to the tax man (as per your instructions). and we've even booked the appointment (8pm on 6th July) because we are so organized. This is a genuine first for us, we are usually still scrabbling around at the end of August in a panic.

Life in the Bumstead household is great at the moment. Don't get us wrong, we still have our ups and downs but it's so much better than it was. Even the kids are happier and calmer, and we thought we had kept our money worries away from them. Turns out they knew something was up, and didn't want to upset us by letting on. No wonder we were all stressed out.

They are both doing their best to help save money and Cookie has become very good at finding the specials and bargains for things we need. She seems to have a knack for sniffing out a good deal, especially on clothes and eating out.

That's about it from the Bumsteads this month, not much to report at all.

Blondie and Dagwood

Dear Blondie and Dagwood,

I just loved hearing you didn't have much to report, that really is fantastic.

Look how far you've come in just six months, you have accomplished quite a lot:

- You have a Spending Plan

- You have a realistic Payment Push

- Blondie has cut her hours and you are coping beautifully

- Your children are learning to be fiscally responsible by your example

- You are saving money for the first time in your married lives

- You are building an Emergency Fund for the first time in your married lives

- You can pay bills on time from your Peace of Mind account

- And you have all your tax information ready for your appointment on the 6th July

Give yourselves a pat on the back for all you have accomplished. And then make a commitment to stick to your plan. It's easy to get sidetracked by a little success and fall back into those bad old habits. Reward yourselves with a treat, perhaps dinner and a movie or a weekend away with the boat, fishing. And then it's back to business.

You have a goal to be debt free and to buy your own home so you need to stay focussed. I know you can do it, you are pulling together as a family and that makes a big challenge so much easier.

How is the veggie garden going? You didn't mention it this month. Hope it's still feeding you all, let me know what you're growing.

I am so very pleased for you all and I can't wait until you tell me the last debt is paid.

Meet the Bumsteads - Part 8

Dear Cath,

It's Blondie here, with our monthly update.

Well it has been quite a month. After a nice quite June, July took us by surprise. Dagwood has been sick, so no work. No work means no pay - and now we really understand why you weren't as excited as us when I went part-time.

Thankfully we have been able to keep up with the bills - thanks to a baby Peace of Mind account, Emergency Fund and our Spending Plan . I have asked if I can go back to full-time and my boss has been fantastic. I have actually increased my hours already. As soon as we knew Dagwood would be off work for a while I started doing more.

We have re-worked our Spending Plan and talked to my mother. Sadly we won't be debt free quite as soon as we thought but if we are very strict with ourselves we won't get any deeper into debt and Mum has been fantastic too and has told us we can put re-paying her on hold until we are back on our feet.

Dagwood was stressing over how we were going to manage, and to be honest I was a little too, but we have the plans in place and yes, we made them realistic, and we will be fine.

Our biggest problem is not having private health insurance but so far our out-of-pocket expenses have been manageable and our doctor has been great at finding bulk billing for all the pathology and x-rays etc. He's even told us the generic medicines which has saved us a small fortune.

I have been doing a Bare Bones grocery challenge and using lots of the $2 Dinner recipes and they have kept the grocery bill down to under $45 each week for the last three weeks. The pantry and freezer are looking bare now, but I've discovered that I must be a food pack-rat because we have still had good meals.

The kids have been great. We told them we would be on a really, really tight budget while Dagwood is off work and they have turned into little spending police, questioning everything and asking how much it costs, and looking for cheaper alternatives.

The school holidays were unbelievably good considering we didn't have the money for the kids to go anywhere or do anything special. They both still managed to have a lot of fun, it was just here at home. Cookie had a couple of sleepovers and apart from the extra meals they didn't cost a cent. She asked each of her friends to bring a CD and a DVD with them and they listened to the free music and watched free movies and had a ball.

Alexander had his mates over a couple of days for game marathons, but he spent most of his time studying - exams are coming up fast . Again, no extra cost involved and they all seemed to have a good time.

To stop me impulse buying I have emptied all the cards out of my purse and I have no more than $20 cash on me unless I am going to buy a specific thing. When I want petrol I withdraw $60 from the bank and then I can only buy petrol. I am doing the same with the groceries, I take $50 with me and a calculator and the shopping list. I stop as soon as I get everything on the list - so far hasn't gone over $45 like I said. I have been putting the leftover $5 into a jar for regular budget emergencies - school excursions and things that are off our spending plan at the moment.

Blondie

Dear Blondie,

You have a lot on your plate - but you sound so in control.

I am sorry to hear Dagwood is ill, but very glad to hear he is on the mend and will be back to normal in a few weeks.

It's a shame you had to learn about the importance of a Peace of Mind account, Emergency Fund and a Spending Plan like this but I am so proud of the way you have dealt with the sudden loss of income.

You have come along way, as a family and individually, this year. If you had been faced with a financial crisis like this a few months ago what would you have done? I'm thinking you would have either kept on using your credit cards or borrowed even more from your mother. Either way would just have seen you deeper in debt.

Today you have control of your money and your spending. You use money as the tool it is, not as a way to make you feel better, however temporary it may have been.

The Bare Bones challenge is fun isn't it? And it gets easier each time you do it. And how about keeping the grocery bill so low? That is great, just remember the healthy eating pyramid - you don't want to end up with malnutrition just to keep the grocery bill down. The Bare Bones challenge isn't meant as a long-term plan, it is for emergencies, just like you have faced.

I love your plan to stop impulse spending too. I love having "whole notes" in my purse and will do just about anything to not break them.

Now I heard a fun way to save this week. Apparently a Berocca tube holds $60 worth of $2 coins. If you know someone who takes Berocca (or the generic equivalent) perhaps they can save a tube for you. If you save your $2 coins you could use the $60 for a family treat every now and then. It is important that you still have the things you really like occasionally and saving up for them means you can still have some fun, even on such a tight budget. It might take you three months to save the $60, but it is something to look forward to.

Because you have so much on I won't give you any new tasks. Keep going as you are, and remember to login regularly to get a Cheapskates fix. And keep me posted, I'm only an email away.

It's Blondie here, with our monthly update.

Well it has been quite a month. After a nice quite June, July took us by surprise. Dagwood has been sick, so no work. No work means no pay - and now we really understand why you weren't as excited as us when I went part-time.

Thankfully we have been able to keep up with the bills - thanks to a baby Peace of Mind account, Emergency Fund and our Spending Plan . I have asked if I can go back to full-time and my boss has been fantastic. I have actually increased my hours already. As soon as we knew Dagwood would be off work for a while I started doing more.

We have re-worked our Spending Plan and talked to my mother. Sadly we won't be debt free quite as soon as we thought but if we are very strict with ourselves we won't get any deeper into debt and Mum has been fantastic too and has told us we can put re-paying her on hold until we are back on our feet.

Dagwood was stressing over how we were going to manage, and to be honest I was a little too, but we have the plans in place and yes, we made them realistic, and we will be fine.

Our biggest problem is not having private health insurance but so far our out-of-pocket expenses have been manageable and our doctor has been great at finding bulk billing for all the pathology and x-rays etc. He's even told us the generic medicines which has saved us a small fortune.

I have been doing a Bare Bones grocery challenge and using lots of the $2 Dinner recipes and they have kept the grocery bill down to under $45 each week for the last three weeks. The pantry and freezer are looking bare now, but I've discovered that I must be a food pack-rat because we have still had good meals.

The kids have been great. We told them we would be on a really, really tight budget while Dagwood is off work and they have turned into little spending police, questioning everything and asking how much it costs, and looking for cheaper alternatives.

The school holidays were unbelievably good considering we didn't have the money for the kids to go anywhere or do anything special. They both still managed to have a lot of fun, it was just here at home. Cookie had a couple of sleepovers and apart from the extra meals they didn't cost a cent. She asked each of her friends to bring a CD and a DVD with them and they listened to the free music and watched free movies and had a ball.

Alexander had his mates over a couple of days for game marathons, but he spent most of his time studying - exams are coming up fast . Again, no extra cost involved and they all seemed to have a good time.